New In-Depth Resource: Uses and Limitations of Investee Scope 3 Disclosures for Investors

19 March 2024

Our new resource looks at the state of play in this tricky but important area. It also includes practical steps investors can take now to meaningfully report on investee’s scope 3 emissions.

Download the Paper

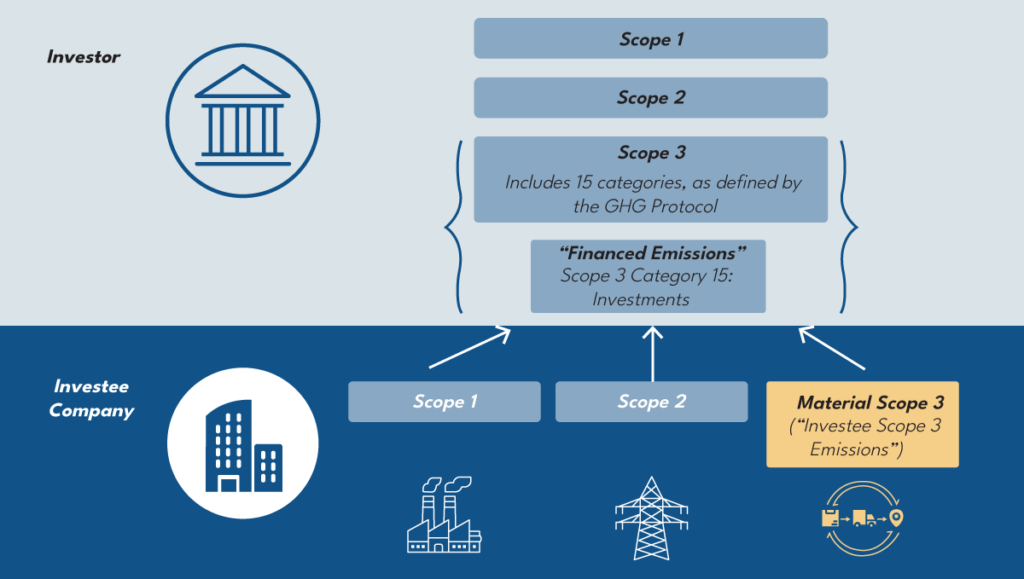

Emissions in an investee company’s value chain – their Scope 3 emissions – can be significant and create investment risks.

Investors need data on investee value chain emissions

This report outlines how an investee’s Scope 3 emissions data can provide investors with valuable insights to help them manage their exposure to climate risks and opportunities. Investee Scope 3 information can also inform investors’ stewardship and engagement with investee companies.

The report draws on investors’ perspectives collected in roundtables and one-on-one discussions with IGCC members in Australia.

Limited investee disclosures create challenges for investors

Investors have observed that the availability and quality of current investee disclosures on their Scope 3 emissions varies considerably.

Current limitations include:

- Widespread use of estimated and proxy data

- Variability in data measurement and quality

- Lack of standardised sector-specific guidance

- Variation in reporting timelines and methods used by data providers

Investors in the region and beyond are grappling with complexity in the data and its implications for measuring and reporting their own financed emissions and setting climate targets.

Considerations for investor climate reporting

In this context, the report explores several practical ways that investors looking to include investee Scope 3 emissions in their climate disclosures might address these challenges and publish meaningful information.

These considerations include:

- Indicating the completeness and quality of data

- Disaggregating data and focusing on relevant sectors

- Setting asset level targets to improve investee performance

The introduction of mandatory Scope 3 reporting in a growing number of jurisdictions – including Australia and New Zealand – is likely to encourage investee companies to improve their disclosure practices.

Investors, too, can play an important role in accelerating these improvements to promote greater consistency and more robust disclosures by engaging with investees, standard setters, policymakers, and external asset managers.

Download the Paper