IGCC Summit 2023: Key Moments and Takeaways.

25 August 2023

300+ climate finance professionals and excellent speakers.

Key Moments

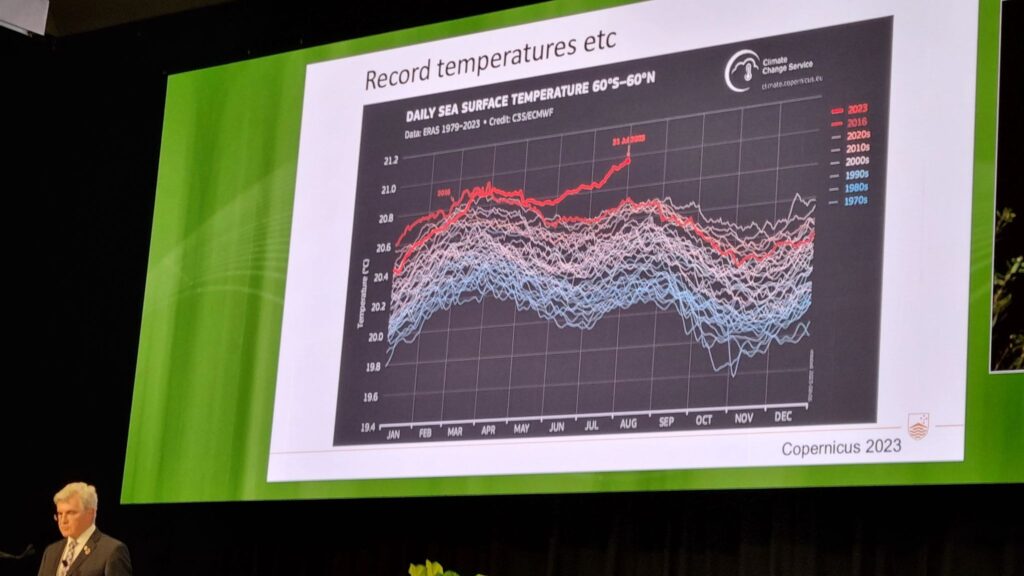

- Facing the Reality: Professor Mark Howden’s latest data included a stark illustration of how radically-high sea temperatures are this year (see above), but also showed :”Action on climate change is much cheaper than inaction, which makes no business sense at all”.

- Cultivating Climate Courage: Dr. Anika Molesworth called for courage to view climate change not just as a challenge, but also as a realm of unprecedented opportunities. Her slide listing the huge set of research and innovation topics in sustainable agriculture struck home for many delegates.

- “Investment in adaptation is an investment in our long-term stability”, said Senator Jenny McAllister, helping to launch our physical risk strategy. She signalled that the government was ramping up their focus on adaptation, and a climate resilience role for the National Reconstruction Fund.

IGCC members will have access to videos of those sessions to rewatch or share with colleagues.

More Takeaways:

- The resounding call to “transition faster” echoed throughout the discussions, reinforcing the need for immediate and ambitious actions and opportunities.

- Investors say the sector-by-sector climate pathways and targets, now under development, will be hugely influential in their investment decisions and the country’s economic trajectory.

- “Electrify everything”: Professor Frank Jotzo emphasised that building or buying new things that use fossil fuels are not climate-compatible investments.

- Climateworks Center CEO, Anna Skarbek, noted there just six “regional” locations, near ports, which are responsible for more than half of Australia’s emissions, but drive ⅔ of Australia’s foreign income. This could be quite a manageable number to focus transition policy upon.

- Transitioning fossil fuel dependent regions needs wider perspectives and wider concepts of what transition investments could be: Social services, like childcare and healthcare, are crucial for retaining the workforces for new regional businesses.

- The specifics of Australia’s climate opportunities are becoming more clear: For example, green iron could become an export business as big as LNG exports are now. (Lots of people have already been excited about hydrogen.)

- The Wilderness Society released its Deforestation report. Financiers in Europe and elsewhere are already considering nature and biodiversity risks, and will soon be legally required to do so. That means Australian sectors with exposure to those risks may also be at risk of capital flight.

- Investors engaging directly with governments fosters policy certainty, enabling bold and impactful actions. The state of change we’ve already seen in the past few years is testament to this.

- Adaptation plans aren’t just necessary for resilience; they’re becoming essential components of strong business strategies.

- Businesses and governments still need to be setting and meeting net zero targets. It’s never been more important.

- The imminent growth of the green products market in Asia presents substantial opportunities for Australian investors.

- Different forms of greenwashing, from association, transition-washing, and by offsets were dissected for better clarity.

A heartfelt thanks to all our speakers, sponsors, and attendees who made this summit an inspiring experience. We’ll keep turning insights into actions.